- A COVID-19 vaccine would mark the top in stocks and set the stage for a rotation from growth stocks into value stocks, Bank of America said on Friday.

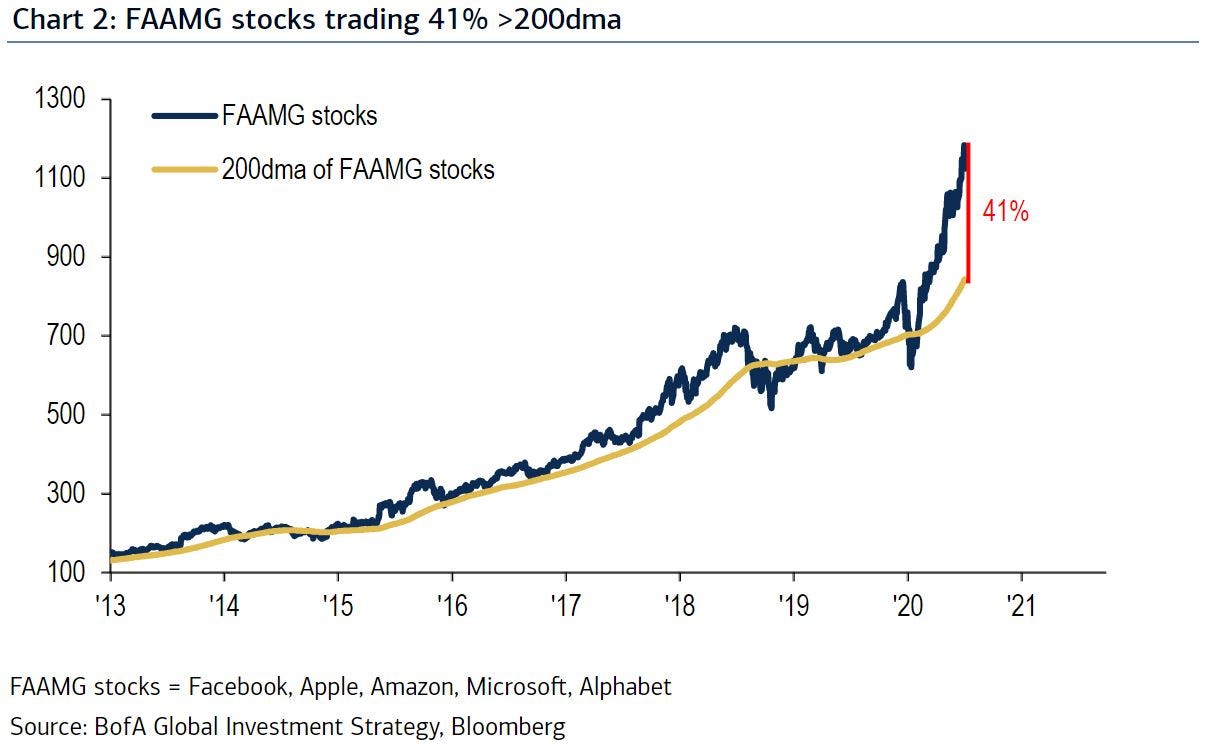

- Technology stocks remain overbought even after Thursday’s steep sell-off, and a composite index of five mega-cap tech names are trading 41% above its 200-day moving average, according to BofA.

- The massive gap between the composite index price and its 200-day moving average signals that any sustained correction in tech stocks could be extremely sharp.

- A sell-off in tech stocks also reflects investor “impatience” with the delayed passing of another stimulus bill from Washington, D.C.

- Visit Business Insider’s homepage for more stories.

While the economy is eager for a COVID-19 vaccine to be developed to enable a full reopening, investors in the stock market may have different feelings.

In a note published on Friday, Bank of America said a positive COVID-19 vaccine development would mark the “end of tech dominance” and is the missing catalyst for a rise in interest rates.

The technology sector has been leading stock market gains since the March 23 bottom, in part due to increased business as tens of millions of workers transitioned to remote work.

But another factor driving tech stocks higher has been near-zero interest rates, which lower the discount rate utilized for valuation-based investors and makes it more acceptable for rising valuations relative to other asset classes like bonds.

A COVID-19 vaccine would likely lead to a surge in economic activity, which would boost interest rates, leading to a surge in the discount rate and the relative valuation of tech stocks looking less attractive to other assets.

"[COVID-19] vaccine likely big top for credit and stocks and big low for value vs growth," BofA said.

A composite index of five mega-cap tech stocks created by BofA is trading 41% above its 200-day moving average, signalling that a sustained sell-off in tech stocks would likely be a sharp one.

The composite index is made up of Facebook, Amazon, Apple, Microsoft, and Google. At its peak in March of 2000, the Nasdaq index traded 55% above its 200-day moving average, so today's tech run has not yet exceeded the extremes of the dot-com era bubble.

A continued sell-off in tech stocks would likely reflect investor "impatience" with the delayed passing of another stimulus bill from Washington, D.C.

Still, stocks can continue to move higher, BofA conceded. An S&P 500 surge to 3,630 prior to the November presidential election remains possible, which would represent a 5% surge from Thursday's close.

The monetary policy from the Fed would be the main driver of stocks from here. "Historic policy shift underway at Fed, willing to let financial assets overshoot to stoke employment & wages and finance fiscal excess," BofA said.